Earlier analysis used earnings because at that time credit periods were small or nonexistent and therefore earnings to some extent meant cash flow. They cannot pass on the earnings that they may have recorded on accrual basis to creditors to satisfy their claims. This is because a company has to pay its interest and retire its debt by paying cash.

In such innovative amortization, there may be years when the company has to pay a lot of interest and other years when it has to pay none. Some of these schemes include interest only payments, bullet payments, balloon payments, negative amortization, so on and so forth. Companies have access to a variety of financing schemes. This assumption is implicit in the fact that while calculating total debt (denominator) we take the interest and principal payments from the present year financial statements. Does Not Cover Amortization: The cash flow to debt ratio assumes interest and principle payments will be paid in the same manner over the years as they have been paid in this year.

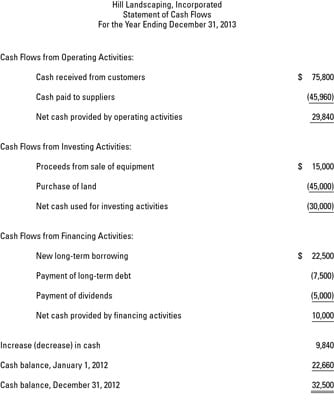

This debt includes interest payments, principal payments and even lease payments to cover off balance sheet financing. For instance if the ratio is 0.25, then the operating cash flow was one fourth of the total debt the company has on its books. The cash flow to debt ratio tells investors how much cash flow the company generated from its regular operating activities compared to the total debt it has. Cash Flow to Debt Ratio = Operating Cash Flow / Total Debt Meaning

0 kommentar(er)

0 kommentar(er)